As workplace pension plans change and even disappear, and many face the challenge of having to take the initiative when it comes to savings, Canadians may not be able to retire as early as they hope to.

A recent TD Bank report found the average Canadian wants to retire at age 61, and that number is even lower when younger people are asked the same question.

But most experts say the average Canadian is not ready for retirement.

Entrepreneur Jeff MacIntyre runs Wine Expert, and while he says there are a lot of choices when it comes to wine at his store, there isn't the option to have an employee pension plan.

"I do know a number of people that don't have any money set aside yet," he says, "You would like to do everything for your employees, you would like to give them more money…and you would like employer-sponsored benefit plans such as pension, but bottom line, I've got to keep my costs in line, maintain my profitability."

Only 39 per cent of Canadians have a workplace pension, and more than half of those are government employees.

And that number is expected to continue to drop. The number of people with defined plans has dropped from 44 per cent in 1992 to about 34 per cent, with three quarters of that decline in the private sector.

Significant job losses in the manufacturing sector have also pushed the number of employees with pension plans down.

MacIntyre voices the concerns many Canadians share about what could happen down the road.

"It's alarming, more than anything. What are we going to do in the future? There are only so many part-time jobs and people can only work to a certain point in life. I am more afraid of the future, what it means for the burden on the Canadian population."

While the public sector isn't facing the same degree of pressure, they are still feeling the push to reduce costs at both the federal and provincial levels.

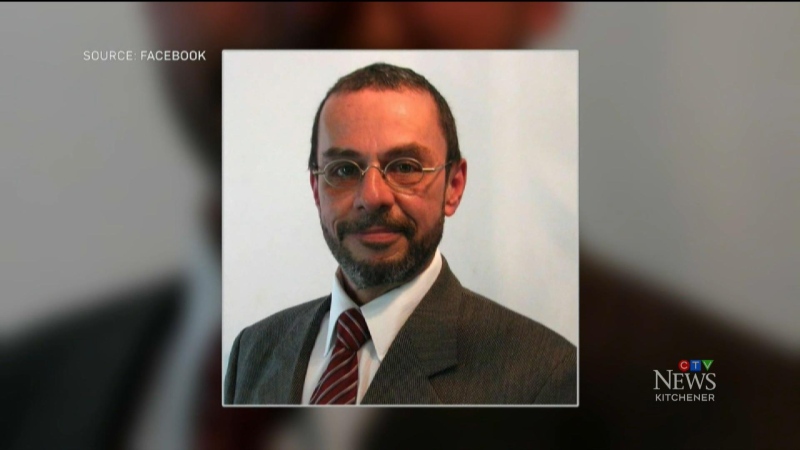

Economist Larry Smith at the University of Waterloo says in the future, even if you have a workplace pension, it may not be enough to live on or even be there at all.

"More and more workers - it's already happening and I think it will continue - will be forced to take responsibility for their own retirement, and in particular the risk of how much they will have."

He says those who don't or can't save will have to remain in the workforce past the age of retirement, and in many cases, longer than they ever expected.